The Benefits and Risks of Investing in Student Housing Buildings

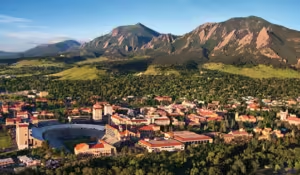

I remember my days at Carroll College, where student housing was little more than basic dormitories—bunk beds crammed into small rooms, communal bathrooms, and a dining hall that served as the heart of campus life. It was a rite of