You read that right, there is simply too much cash in the capital markets to not see a handful of effects that could impact your investments and plan. The supply of money floating around is massive right now. There is a lot of risk, COVID has us concerned about the economics of the coming year, but it’s getting harder and harder to ignore how much cash has been made available.

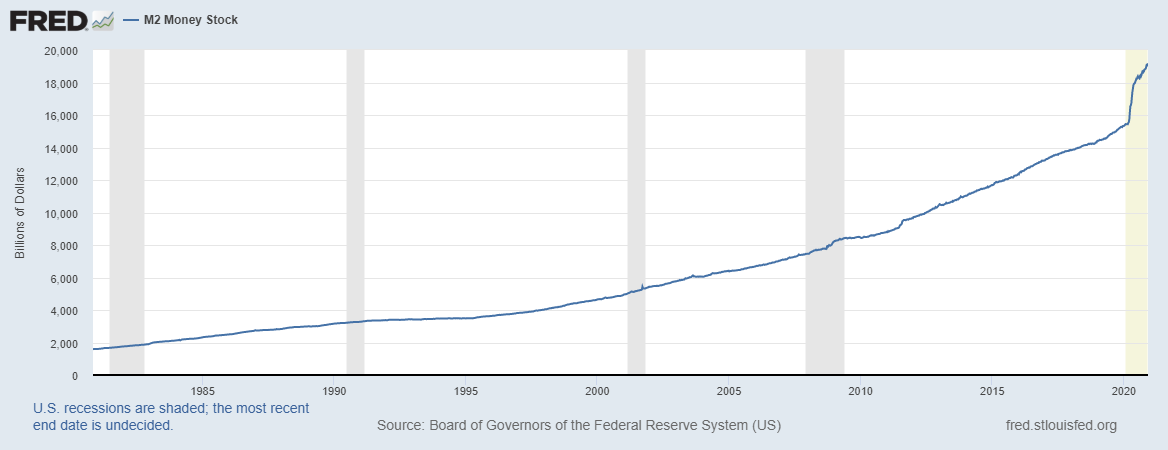

Even relative to itself, it’s a volume of cash in the money supply that will take at least a decade to settle into long term investments, or be recaptured by the Fed. At the beginning of the year there was roughly $15T in circulation held in cash and cash equivalents. We are in December and the number is closer to $19T of more highly liquid cash in the world. This $4T expansion in only 12 months is remarkable.

Here’s some history on money supply. It took until 1997 to reach the first $4T in circulation, the decade from 2009 to 2019 saw that supply double from $8T to almost $16T (the fastest doubling ever), resulting in a major part of the expansion of the stock market for that decade. Now, in twelve months we have seen a flood of almost 27% more money in the supply than there was at the beginning of the COVID-19 pandemic.

One of the best leading indicators for where capital markets are headed, can be found in how much money, especially highly liquid money like cash, is available in the system. This is a reflection of how big the pie is. Usually in investments we are focused on cash flow, and a companies market share – or how effective a company is at capturing cash flow from a given size of market. That’s becoming less relevant as the sheer volume of cash has exploded. The pie is so big right now that there will have to be a a few notable adjustments to make:

Inflation – While I have heard that Jerome Powell has not registered an increase in inflation yet, it is hard to believe that as the newly introduced money will not have an expansive effect on the costs of goods and services. Many mark the inflation rate off the CPI, grievances with that benchmark aside, it would be irresponsible to assume that the basket of securities they mark to market does not see an above average increase as more money finds its way into the same number of consumer goods. Additionally, elements like rents will see a disproportionate increase in the coming decade because while supply of say consumer goods will increase quickly to capture this cash, construction of rental properties is a less reactive market and a slower roll out to correct the market. In the meantime expect rental costs and revenues to see above average inflation figures.

Interest Rates – Permanently impaired. As I write this the current observation, the 10 year US Treasury is paying 0.9%, a third of where it was even 2 years ago. It is heard to believe that such a robust introduction of cash doesn’t become a permanent downward pressure on fixed income assets for the foreseeable future. Unless there is a formal and aggressive contraction of the money supply, it will take decades for the amount of cash in circulation to let up that downward pressure on bonds. Interest rates in short term assets will be particularly affected as the demand has become less appetizing in contrast to long term debt, and the supply of cash is chasing too small of demand.

Equities – The real benefactor here. It is hard not to believe that over the course of the coming decade, this cash infusion doesn’t trickle its way up and into the stock market and other asset values. Generally the most “risky” part of the market is the historically the benefactor of excesses in cash. Companies will do what they do best and capture this supply of cash through normal operations, this will expand their revenues and ultimately the bottom line. Additionally, the compressed borrowing costs from low interest rates will lower their operating costs. Compound the poor risk reward ratio in bonds and you will see more of those investments seek out stocks, real estate, and other capital assets. This sector will see a virtuous combination of more revenue, and more demand for shares. Expect permanently elevated P/E reads for the time being.