In the bustling world of financial fortitude, there exists an elite group known as the Fantastic Financial Four: Alex Annual, Morgan Monthly, Quinn Quarterly, and Yuki Year-End. Each with its unique savings discipline, paints a vivid picture of investment prowess and the magic of compound interest.

Alex Annual rockets out of the gate, depositing a whopping $12,000 on the very first day of the year. The mantra? “Make the money work from day one!” And work it does, earning them dividends and returns right from January.

Morgan Monthly dances in with a regular rhythm, spreading her $12,000 across twelve orchestrated monthly performances. Consistency is her game, and every month she harnesses the power of incremental investments.

Quinn Quarterly takes the stage four grand times a year. With each act, $3,000 takes its position, ensuring that every quarter makes its mark.

And then there’s Yuki Year-End, the master of the grand finale. Waiting for the year’s curtain call, she pours her $12,000 into the pot, ensuring she doesn’t miss out on the annual investment extravaganza.

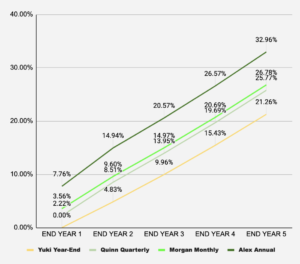

Now, while each contributes an equal $60,000 over five years, their returns sing different tunes. Alex, with the longest time in the market, witnesses the marvel of compound growth to its fullest. Morgan and Quinn, while not at Alex’s peak, still enjoy substantial growth, thanks to their steady and spaced-out approach. Yuki, despite her year-end dazzle, finds herself with the least returns due to her shorter time in the market.

Their collective journey unravels a crucial lesson: It’s not just about the amount, but also the time. While automated approaches, like Morgan and Quinn’s, might not capture the full magic of Alex’s year-long market time, they still earn substantial returns compared to last-minute lump-sum investments.

In the grand theater of finance, the Fantastic Financial Four reminds us that to truly reap rewards, “time in the market” often trumps “timing the market.” Whether you’re an Alex, a Morgan, a Quinn, or a Yuki, the key is to start, stay disciplined, and let time weave its compound magic.

Each of these market participants is invested the exact same, earning the average return and dividend for the SP500. The only difference is, how many months each of the money they add is participating in the market.

Alex Annual: The Savings Superhero!

Who said superheroes wear capes? Meet Alex Annual, the savings sensation who’s turning heads and flipping calendars in the financial world! On the first day of the year, while most of us are nursing our New Year’s Eve hangovers or breaking our resolutions already, Alex is smashing his entire annual savings goal. Bam! Just like that.

Not all of us can be like Alex, and not all of us need to. But this kind of planning, habit, and market participation earns Alex a full 1.2% a year more than his counterparts. This outperformance only comes from time and a few extra dividends, and it requires that have a plan in place to make these investments as soon as the calendar rolls over.

So, Alex is a timely and highly planned investor and something you can work toward…but for most, this is just too much.

Morgan Monthly: The Investment Icon!

Introducing the legend, the guru, the monthly maven of moolah – Morgan Monthly! While some of us are just remembering to change the date we are looking at on our phones, Morgan’s already making her big investment moves. First day of the month? You bet she’s in the financial frontline, adding a sprinkle of investment glitter to her growing treasure trove.

But hold your horses, this isn’t about hasty decisions or risky gambles. This is the Morgan Method™: a combo of routine, and habitual decisions made long ago, and something that she said she could live within her Insight-Full® financial plan.

So, even though Mogan is not making a big lump sum at the start of the year, they get 81% of the returns that Alex gets but doesn’t feel strapped from “oversaving” early in the year.

Quinn Quarterly: The Bonus Boss!

Number 3 on our list, but number one among savers who get quarterly bonuses – Here comes the quarterly sensation, the bonus bonanza guru, the financial phenom – Quinn Quarterly! While most are just counting the days to their next payday, Quinn’s got their eyes on the bigger prize. Every quarter, right on schedule, the bonus bell rings, and Quinn is dancing all the way to the savings bank!

But wait, it’s not about luck or merely waiting for the stars to align. It’s the Q-Strategy™: Every bonus, every time, diligently directed to the future’s treasure vault. No ifs, no buts, just pure, automated savings brilliance.

Perfomrativly this method is almost identical to the monthly method, and for those who get a monthly bonus as part of their employment, it’s an easy bridge to cross. Quinn gets 78% of the return of Alex who’s invested all year long.

Yuki Year-End: The Yearly Yen!

As the calendar winds down and most are getting lost in the holiday haze, there emerges a savings superstar from the shadows – Yuki Year-End! While many are busy planning New Year’s Eve bashes, Yuki’s preparing for a different kind of bash: a savings bonanza!

This is the last-minute saver, and they pay the price. While still better than doing nothing all year, investing at the end of the year, with tax returns, holiday bonuses, or whatever is left over comes with a hefty price tag. Yoki is only participating in 64% of the returns that Alex received.

So better than nothing, but for most the jump from a 4.25% annual return to a 5.36% is as easy as converting to a monthly or quarterly goal.

Key Takeaway: Strive, Thrive, and Automate to Elevate Your Savings Game

The Fantastic Financial Four offers a mirror to our savings aspirations. While we may find ourselves identifying with one of these savers, the journey doesn’t have to stop there. The beauty of the savings discipline is that it’s adaptable.

Starting your savings journey? Aim to step into the shoes of any member of our quartet. However, for many, the rhythmic and automated dance of Morgan Monthly strikes as the most achievable first step. It’s consistent, spaced out, and a fantastic way to immerse oneself in the discipline of saving regularly.

Yet, if you’re already channeling your inner Morgan, why not aspire towards the ambitious cadence of Alex Annual? Moving up this ladder isn’t just about saving; it’s about maximizing your returns through increased time in the market.

Remember, the formula remains simple yet profound: Income – Savings = Expenses. This tale underscores the importance of prioritizing savings and automating them. It’s not just about how much you save, but how soon and how consistently. Aim high, start where you can, and let automation be your financial co-pilot.