Few can doubt that the future of investment in America is in technology, and the future of technology is in data. As Texas deals with a historic cold snap the nation is seeing the knock-on effect of power supply affecting the throughput and capacity of their company websites. As Amazon and Google work to move data capacity away from Texas and to other parts of the country we’re seeing the future of technology unfold. The real estate requirements that support the future of technology, the land and buildings that house massive, and power-consuming data centers.

The world currently is home to about seven billion internet-connected devices, and that number continues to grow. Most of these devices generate a constant flow of data that must be captured, routed, stored, evaluated, and retrieved. With the rise of the Internet of Things (IoT), entire industries rely on big data and data analytics, and the demand for data centers has never been greater. The opportunities set is also fantastic. The real estate opportunity for data centers is great, the land is generally speaking cheap, and the capacity for improvement is great. Historically, the ability to improve on raw land was limited to a location’s proximity to expanding cities. The rise in data centers, however, expands that opportunity set to include high-powered data centers that are only limited by their supply of power and limited human capital to man the facilities.

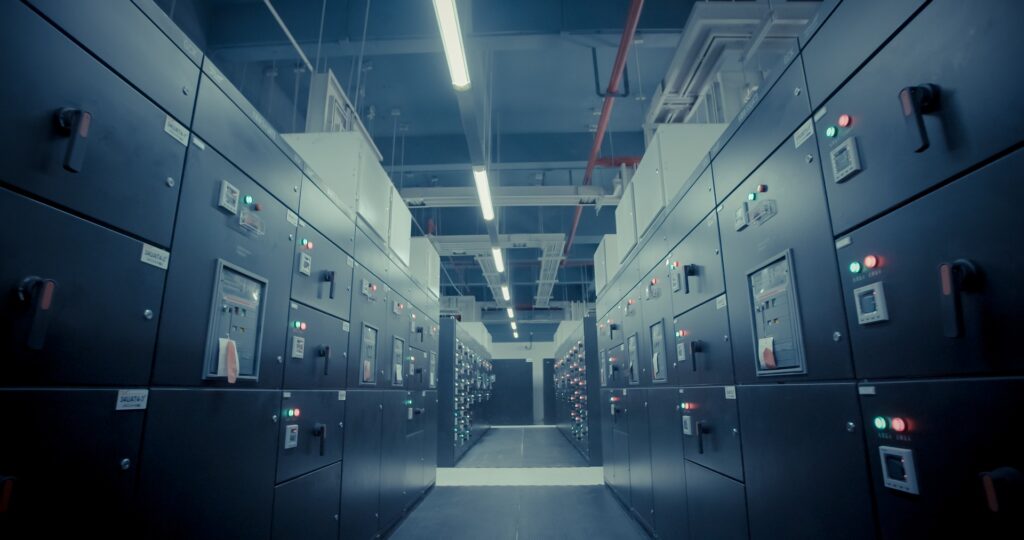

The growing number of companies outsourcing their data operations to third-party providers that specialize in data center operations is the next digital gold rush. Colocation data centers are especially popular because they provide physical space, power, and cooling systems for servers and connections to local communication networks without the long-term capital expenses required by the company. Additionally, this allows companies that are not inherently “tech” companies, to house and manage their own data with proficiencies they may not have today. Large colocation providers include Iron Mountain, QTS, Equinix, CoreSite, Digital Realty, Compass Data Centers, and Cologix, which provide rentable space up to 100,000 square feet or more.

InSight expects the global data center market to grow at a growth rate exceeding 2% a year from 2021-2027, and possibly 3-4% in the decade from 2030-2040. In the U.S. alone, we expect the data center market is expected to reach revenues of over $69 billion by 2024. The most likely expansion in the space is going to be in colocation service providers and hyperscale data centers (owned and operated by the company it supports, such as Apple or Google). In the U.S., the strongest growth by region has been and is likely to continue to be in the pacific northwest and the southeast.

Where do we expect to see Data Center growth?

A few macro drivers InSight thinks will become more prolific in the decades to come are also fueling the demand for data center capacity and superiority. Payments (including crypto) and direct-to-consumer content (AppleTV, Netflix, Google, Amazon Prime, Disney+, etc.) along with video meeting and communication services (Zoom, Webex, and Google Meet) we think will be major sea changes in the coming economy. The backbone of these services will be the speed and capacity that data centers will compete on.

We think the growth in those business categories, coupled with the below existing trends will generate an insatiable desire for data to improve business performance is driving the growth of the data center industry. Key current drivers include:

Internet of Things—the U.S. is one of the leading markets for industrial IoT-driven technologies, including artificial intelligence, data and analytics, security, and communication

Cloud storage—the use of cloud computing services and applications continues to grow rapidly in the U.S., thereby leading to the establishment of large colocation cloud-based data centers

Submarine cable projects along the east coast—these bring extremely high-speed data from Europe and South America to the east coast, where it is routed to data centers where they come ashore (for example, Virginia Beach)

Tax incentives—in recent years, data center growth has been concentrated in regions that provide tax incentives, including state and local governments that provide investment incentives (often energy-based like Texas)

Why does InSight think this will be a steady investment?

The long-term expectations for space are something we like to plan for. The growing data needs—ranging from Tier 1 facilities (least complex and secure) to Tier 4 (very complex with high IT/security requirements), is palpable. The best places for these locations have low energy costs and top-notch communications infrastructure, they also benefit from low and manageable state taxes and property taxes, and low land cost.

Additionally, as companies have moved away from owning and operating their own data centers they have left behind abandoned space that can be upgraded into modern data centers. When these locations are in the right places and have the good supporting infrastructure and low energy costs, colocation service providers purchase them.

How do these companies meet future storage needs?

In the current landscape, the Data-center providers are not building enough new capacity to meet demand. Applications for data and data-backed technologies are far more prolific than the centers are being built. Artificial intelligence and machine learning, the Internet of Things, Payments, Streaming Services, and Real-Time Video services continue to grow. So must the need for next-generation strategies and technologies to transform how we store, manage, and move data.

One problem the colocation and data centers are solving is the byproduct of machine-to-machine technologies. As they continue to generate enormous volumes of data, which is expensive to transmit and store, the solution being considered is integrated colocation. This allows data centers to interconnect and collaboratively support each other and share assets, creating broad capacity and the creation of districts or corridors for data centers to support each other and load balance when needed.

Data-centers are also finding efficiencies through automation, whereby a single administrator can manage thousands of servers simultaneously. The effort of automation is being led by advanced IT equipment and data center infrastructure management software providers.

We think data centers are the common link:

The rise of data centers is going to be an impressive change to the landscape of the county. The ability to monetize traditionally barren places in the country through the development of high-powered and low-cost data centers will be the next land grab in the U.S. and places abroad. We think that the data center is the hub that combines the demand and technology growth for several of the trends we think will be the hallmark of the decade to come. Additionally, we think that the next unknown frontier will likely be built on the combination of the data centers and the rollout of 5G. The unknown frontier will likely put a fantastic and unprecedented demand on data centers.

We think that the best exposure to this space is high-quality, non-traded companies that are currently developing these facilities either as their own assets, or to sell to current operators.