If you’re looking for tax free income in retirement getting as much money into your Roth is the way to go. Tax free growth turns into tax free income. Executing on backdoor Roth strategies can be a little confusing but the math is highly predictive. If it’s right for you, it will support the broader tax strategy in retirement.

When you retire most people think their tax rates will go down substantially. However, for those that have done a great job saving in their 401ks and IRAs, building their rental property empire, acquiring high growth assets, or anyway that’s not an asset in a tax-free account then you’re probably going to stay in a high income bracket throughout retirement. When you take into consideration social security, pensions, RMDs, and rental incomes you may have a difficult time not paying a large percent to the government. If you’re trying to sustain an income of $100,000 in retirement you cannot simply take out $100,000 from your 401ks and IRAs without losing a large chunk of it to taxes. So you’ll have to take out more and more each year in order to sustain your income due to inflation. However, if you’re receiving $100,000 per year from your Roth IRA then you’ll dramatically reduce your effective tax rate for your other tax-deferred distributions due to the Roth distributions being tax free.

Unfortunately, for those high earners you may be thinking it’s not feasible or a smart strategy. I am here to tell you that for some it truly doesn’t make sense but for the majority of people it does and here’s how. If you’re in the 35%+ tax bracket this is a difficult decision; however, if time is on your side it still may be a good idea. For those that are in less than a ~35% tax bracket you’re in a great spot. First, let’s tackle the 35%+ individuals and families.

For high income earners, you have a couple of options. Invest a portion of your 401k contributions to your Roth 401k each year. Some clients like doing a half and half strategy where half goes to the pre-tax 401k and half goes to their Roth 401k up to the annual 415(c) limits. That way, they’re taking advantage of some tax deduction but not fully. Another way is to do a Roth conversion or a backdoor Roth conversion. Now be very careful here, because if you have rolled your 401k into your IRA then certain rules apply to you which I will touch on.

You cannot make a Roth contribution if you file single and make over $139,000 (2020) and can only make a partial contribution if you make between $124,000 – $139,000 (tax year 2020). If you’re married and file jointly, your phase out is between $196,000-$206,000 (tax year 2020), meaning if you make over $206,000 then you’re ineligible. So here’s what you can do:

Unfortunately, for those high earners you may be thinking it’s not feasible or a smart strategy. I am here to tell you that for some it truly doesn’t make sense but for the majority of people it does and here’s how. If you’re in the 35%+ tax bracket this is a difficult decision; however, if time is on your side it still may be a good idea. For those that are in less than a ~35% tax bracket you’re in a great spot. First, let’s tackle the 35%+ individuals and families.

For high income earners, you have a couple of options. Invest a portion of your 401k contributions to your Roth 401k each year. Some clients like doing a half and half strategy where half goes to the pre-tax 401k and half goes to their Roth 401k up to the annual 415(c) limits. That way, they’re taking advantage of some tax deduction but not fully. Another way is to do a Roth conversion or a backdoor Roth conversion. Now be very careful here, because if you have rolled your 401k into your IRA then certain rules apply to you which I will touch on.

You cannot make a Roth contribution if you file single and make over $139,000 (2020) and can only make a partial contribution if you make between $124,000 – $139,000 (tax year 2020). If you’re married and file jointly, your phase out is between $196,000-$206,000 (tax year 2020), meaning if you make over $206,000 then you’re ineligible. So here’s what you can do:

Unfortunately, for those high earners you may be thinking it’s not feasible or a smart strategy. I am here to tell you that for some it truly doesn’t make sense but for the majority of people it does and here’s how. If you’re in the 35%+ tax bracket this is a difficult decision; however, if time is on your side it still may be a good idea. For those that are in less than a ~35% tax bracket you’re in a great spot. First, let’s tackle the 35%+ individuals and families.

For high income earners, you have a couple of options. Invest a portion of your 401k contributions to your Roth 401k each year. Some clients like doing a half and half strategy where half goes to the pre-tax 401k and half goes to their Roth 401k up to the annual 415(c) limits. That way, they’re taking advantage of some tax deduction but not fully. Another way is to do a Roth conversion or a backdoor Roth conversion. Now be very careful here, because if you have rolled your 401k into your IRA then certain rules apply to you which I will touch on.

You cannot make a Roth contribution if you file single and make over $139,000 (2020) and can only make a partial contribution if you make between $124,000 – $139,000 (tax year 2020). If you’re married and file jointly, your phase out is between $196,000-$206,000 (tax year 2020), meaning if you make over $206,000 then you’re ineligible. So here’s what you can do:

Unfortunately, for those high earners you may be thinking it’s not feasible or a smart strategy. I am here to tell you that for some it truly doesn’t make sense but for the majority of people it does and here’s how. If you’re in the 35%+ tax bracket this is a difficult decision; however, if time is on your side it still may be a good idea. For those that are in less than a ~35% tax bracket you’re in a great spot. First, let’s tackle the 35%+ individuals and families.

For high income earners, you have a couple of options. Invest a portion of your 401k contributions to your Roth 401k each year. Some clients like doing a half and half strategy where half goes to the pre-tax 401k and half goes to their Roth 401k up to the annual 415(c) limits. That way, they’re taking advantage of some tax deduction but not fully. Another way is to do a Roth conversion or a backdoor Roth conversion. Now be very careful here, because if you have rolled your 401k into your IRA then certain rules apply to you which I will touch on.

You cannot make a Roth contribution if you file single and make over $139,000 (2020) and can only make a partial contribution if you make between $124,000 – $139,000 (tax year 2020). If you’re married and file jointly, your phase out is between $196,000-$206,000 (tax year 2020), meaning if you make over $206,000 then you’re ineligible. So here’s what you can do:

- A Roth conversion is taking money from your deductible pre-tax IRA and converting it into a Roth. You pay income tax now and the money grows tax deferred for life. You can withdraw that money penalty free after the age of 59.5 or earlier if it’s a qualified distribution.

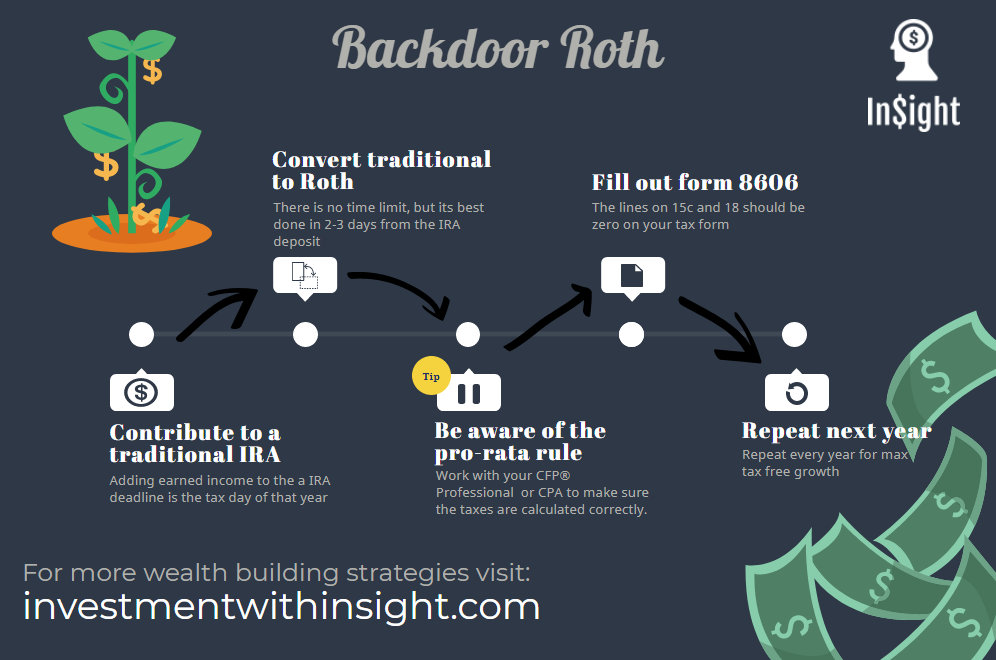

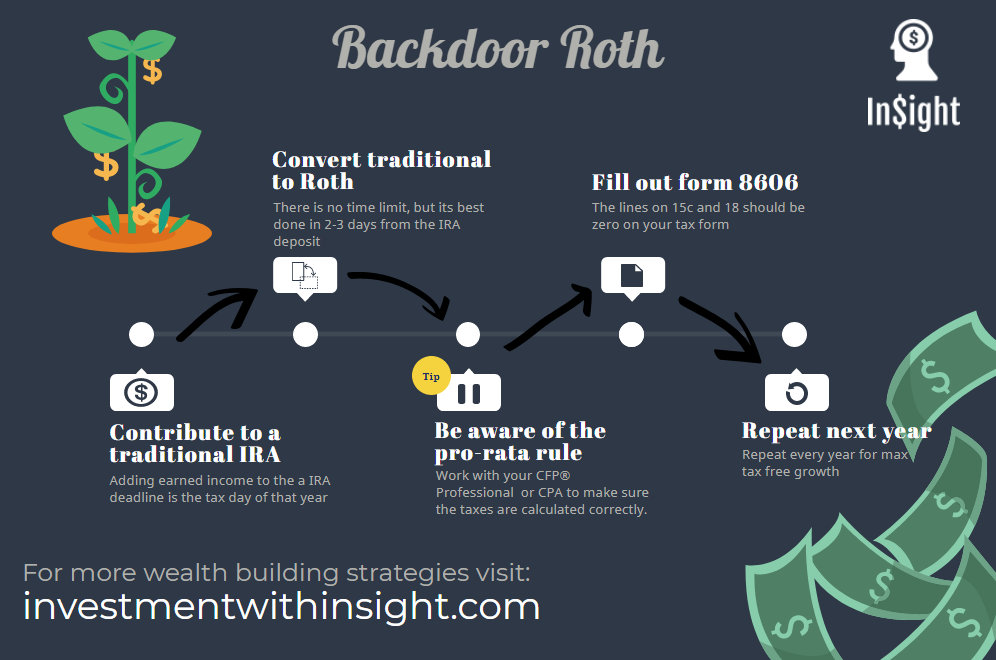

- A backdoor Roth conversion is when you make a non-deductible contribution to an IRA and convert that money into a Roth. The great thing about this strategy is any person with any income can make a non-deductible or after-tax contribution (a contribution that doesn’t reduce your current year tax liability). Before you do this you MUST understand this key rule. If you have a traditional IRA or rollover IRA (not 401k), then you must do a pro rata conversion, which for most, isn’t a great option.

- For example, I have 100k in my IRA and I open a non-deductible IRA and contribute the annual limit ($6,000 if I am under the age of 50 and $7,000 if I am 50+) and want to convert my $6,000 over since I already paid taxes on it and I want it to grow tax free. Well the IRS doesn’t allow you to just convert the after-tax/non-deductible contribution on it’s own and forces you to take a portion of both. In this case, $6,000 makes up 6% of all my IRA money so then I can only convert 6% of my after-tax contribution to my Roth and the rest has to come from my deductible pre-tax IRA because the IRS wants its money now forcing you to pay income tax when you didn’t want to.