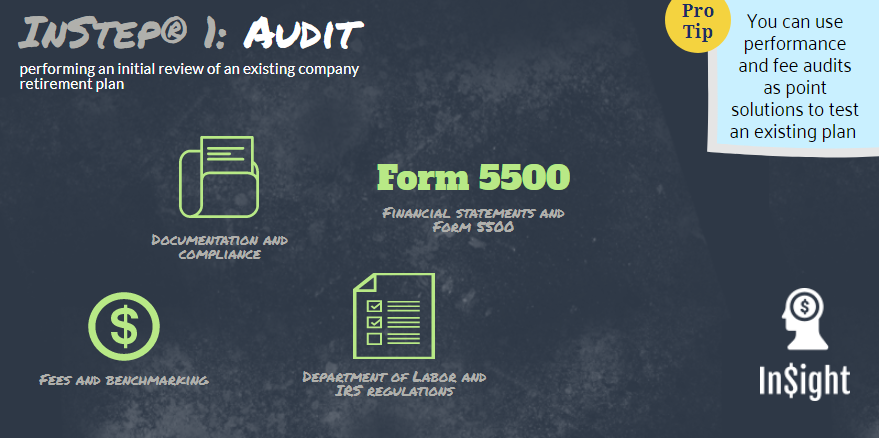

InSight follows the fi360 Fiduciary Quality Management System, staring with an audit. Called the InStep® process, it is a designed and implemented plan for clients in accordance with the prudent practices set forth by fi360. We offer two levels for plan sponsors to begin reviewing and audit their current 401(k) and corporate sponsored plans.

InSight follows the fi360 Fiduciary Quality Management System, staring with an audit. Called the InStep® process, it is a designed and implemented plan for clients in accordance with the prudent practices set forth by fi360. We offer two levels for plan sponsors to begin reviewing and audit their current 401(k) and corporate sponsored plans.

What You Can Review During a 401k Plan Self Audit

Companies interested in performing a self audit can find the InStep® Self-audit tool here. <FORM FOR SELF AUDIT REQUEST>What Our Auditors Review During a 401k Plan Audit

Our InStep® – Fiduciary Audit will focus on 4 areas: Our Accredited Investment Fiduciary (AIF®) will analyze and conduct a thorough audit to make sure the plan is operating within the guidelines of the plan-related documents. Documents will be reviewed in accordance with fi360’s prudent practice to make sure the financial information is reported correctly and the corporate plan is governed properly. A report will be prepared and delivered to the sponsor and investment committee upon completion.Common Errors found in an Audit

Plan Document Failures

These occur when there are incongruencies between the administration of the plan and the governing documents. These can be from both forced and unforced errors that result from a lack of education, clarification, or issues with how the plan documents were written. Issues can also arise when changes to the plan are made over generations of investment committees and changes in one element are not received though the plan documents.Plan Operational Errors

Operational errors are largely transactional, they stem from execution issues in the plan and while costly mistakes occur, they are less persistent in plan administration. These arise either when a transaction isn’t in accordance with the plan document, participant’s instructions, or when the plan fails the non-discrimination test and the timely corrective action isn’t taken. Some common operational errors include:- Failure to communicate plan changes in a timely manner

- Failure to admit participants timely

- Incorrect contribution amounts

- Incorrect vesting percentages distribution

- Self-Correction Program (SCP) – permits a plan sponsor to correct certain plan failures without contacting the IRS or paying any fee.

- Voluntary Correction Program (VCP) – permits a plan sponsor to, any time before audit, pay a fee and receive IRS approval for correction of plan failures.

- Audit Closing Agreement Program (Audit CAP) – permits a plan sponsor to pay a sanction and correct a plan failure while the plan is under audit.