Let InSight break down the 721 exchange, somewhat similar to the 1031 exchange, which provides investors with a smart way to postpone capital gains taxes when letting go of a property that they’ve held for business or investment purposes. These tax-saving strategies present compelling alternatives to the conventional sale process, which often comes with a hefty tax bill, sometimes reaching 20 to 30% of the capital gains (you can use our capital gains tax calculator to estimate your specific situation).

The 1031 exchange permits investors to defer capital gains taxes by selling an investment property and reinvesting the proceeds in a similar asset. However, it might not align with the goals of certain investors. For instance, someone might be attracted to the stable income, tax advantages, and potential appreciation offered by a Real Estate Investment Trust (REIT), which doesn’t meet the criteria for a 1031 exchange.

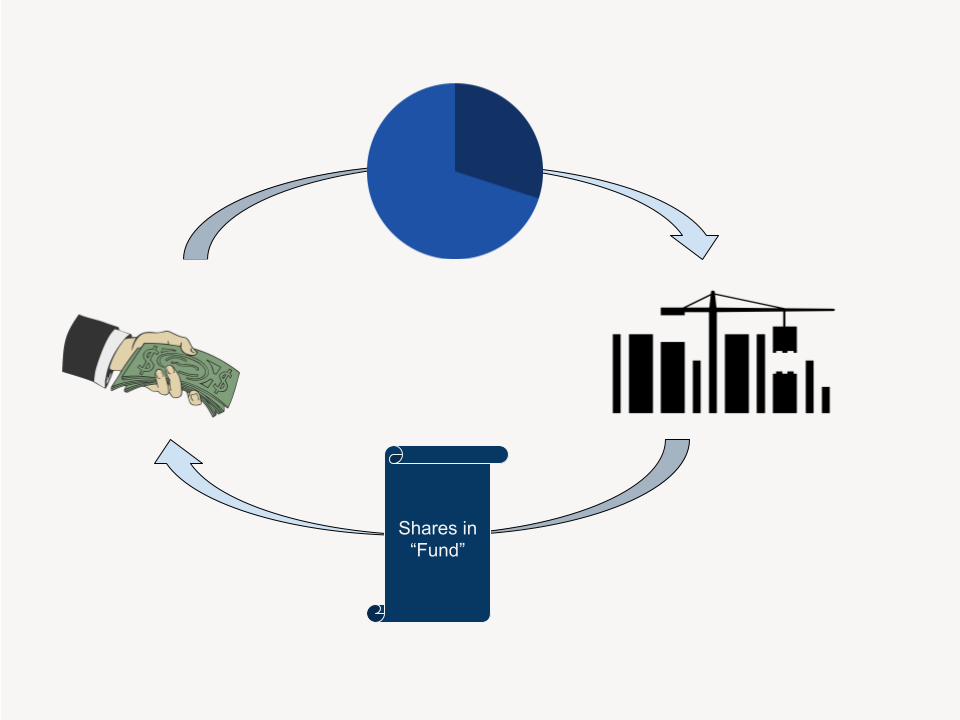

In a 721 exchange, a real estate investor can defer capital gains taxes when selling a property while simultaneously acquiring shares in a REIT. Now, let’s delve into the details with these key questions:

How does a 721 exchange work?

In a 721 exchange, also known as a “UPREIT,” an investor transfers property to a REIT in exchange for units in an operating partnership, which will later convert into shares of the REIT itself.

What are the primary benefits of a 721 exchange?

- Passive Income: REIT shareholders enjoy passive income as professional managers oversee the REIT’s operations and asset management. This means investors can take a hands-off approach while the managers make daily decisions about the portfolio, including acquisitions, dispositions, and distributions.

- Tax Advantages: Thanks to the 721 exchange structure, gains from property sales are deferred. In a standard sale, these gains would be taxable. Combining this tax with depreciation recapture (used to offset property taxes) can sometimes result in a tax burden exceeding 25% of your sale gains. With a 721 exchange, you sidestep these significant taxes and can use the full sale proceeds to buy REIT shares. However, it’s important to weigh this against the fees associated with completing the 721 exchange.

- Diversification: A 721 exchange allows investors to purchase shares of a REIT, which brings diversification benefits. REITs typically hold properties in various geographic locations and offer diversification in tenant types, industries, and sometimes asset classes. This broadens an investor’s interests beyond a single property, providing advantages like real estate appreciation, depreciation tax benefits, and income in the form of dividends.

- Estate Planning: The 721 exchange can be a valuable strategy in estate planning. Physical real estate can be challenging to sell and may lead to disputes among heirs. However, by employing a 721 exchange, the benefits continue during the investor’s lifetime, and upon passing, the shares can be equally divided or liquidated by trust heirs. Since the shares pass through a trust, heirs receive a step-up in basis and avoid capital gains and depreciation recapture taxes deferred by the estate.

Can an investor combine a 1031 exchange with a 721 exchange?

While each REIT has specific acquisition criteria that may not match the property an investor wishes to relinquish, a solution exists. Investors can combine a 1031 exchange with a 721 exchange, allowing them to acquire a fractional interest in high-quality properties that meet the REIT’s criteria. This fractional investment must be held for a sufficient period, typically around 24 months, to preserve the 1031 exchange. The good news is that the investment may generate dividends during this period. Afterward, the fractional investment can be contributed to the REIT in exchange for operating partnership units based on the property’s value, which are then exchanged for direct ownership of REIT shares.

Can an investor perform a 1031 exchange after a 721 exchange?

Unfortunately, REIT shares themselves cannot be used in a 1031 exchange. Therefore, once a 721 exchange is completed, capital gains tax deferral options come to an end. If REIT shares are sold or if the REIT sells a portion of its portfolio and returns capital to investors, they will be required to recognize any capital gains or losses when filing their taxes.