Mastering Reverse 1031 Exchanges: Unlocking Opportunities When Timing Matters Most

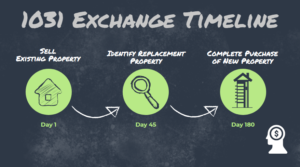

Reverse 1031 Exchange Rules Under IRS rules, Internal Revenue Code Section 1031 states that “no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such